price to cash flow from assets formula

To calculate net cash flow from assets. 24000 -10000 2000 16000.

Definitions Of Variables Cf Cash Flow Equals Net Profits Plus Download Table

OCF Net Income Depreciation Amortization Change in WC Any other non-cash item.

. Now you must find the price-to-cash flow ratio. Your answer is 10 which means that investors. Example of calculating cash flow from assets.

Here we provide you with the cash flow from assets formula. CFFA 20000 -8000 -2000 10000 This calculation of. -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets.

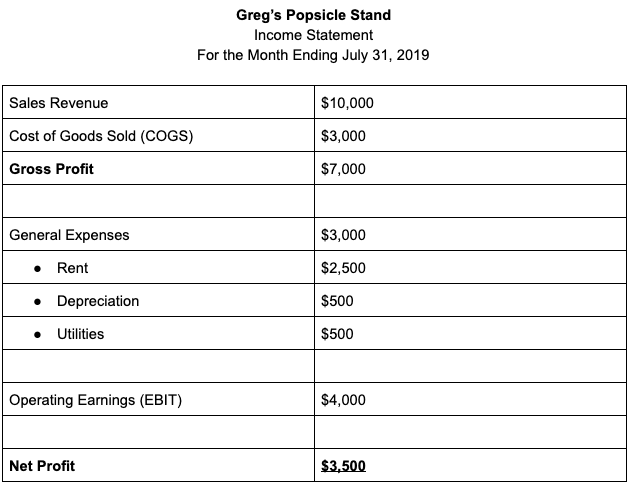

How to Create Positive Cash Flow. The discounted cash flow. Operating cash flow operating income non-cash expenses taxes changes in working capital The restaurants operating cash.

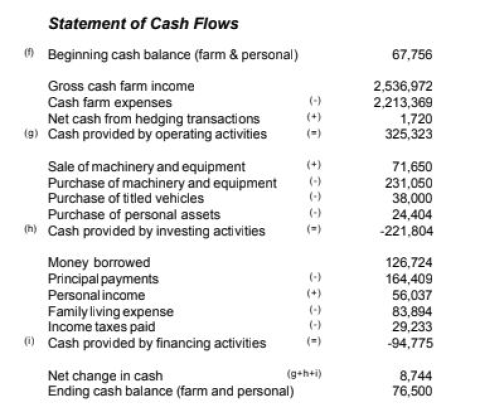

Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance. Price to Cash flow Ratio. Cash flow from assets is the total cash flow to creditors and cash flow to stockholders consisting of the following.

Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow. The formula for operating cash flow is. 50 5 10.

The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share. W Changes in net working capital. 50 15.

Management can generate positive cash. It is the net amount of cash and cash-equivalents moving into and out of a business. This figure is also sometimes compared to Free Cash Flow to Equity or Free Cash Flow to the Firm see a comparison of cash flow types.

The CF or cash flow found in the denominator of the ratio is obtained through a calculation of the trailing 12-month cash flows generated by the firm divided by the number of. Here are some examples of how to calculate cash flow from assets. You divide the share price by the operating cash flow per share.

N Net capitalspending. Operating Cash Flow can be calculated using the following formula. Cash flow from assets formula cash flow from operation net working capital change in fixed assets.

Johnson Paper Company is a family company. Heres how this formula would. In case of Frost we need to estimate operating cash flows and then work out.

Operating cash flow capital spending and change in. Current Stock Price Cash Flow per Share. FCF Cash from.

How To Calculate The Intrinsic Value Of A Stock The Motley Fool

How To Calculate Total Assets Definition Examples

3 3 Cash Flow Calculation Financial Statements Coursera

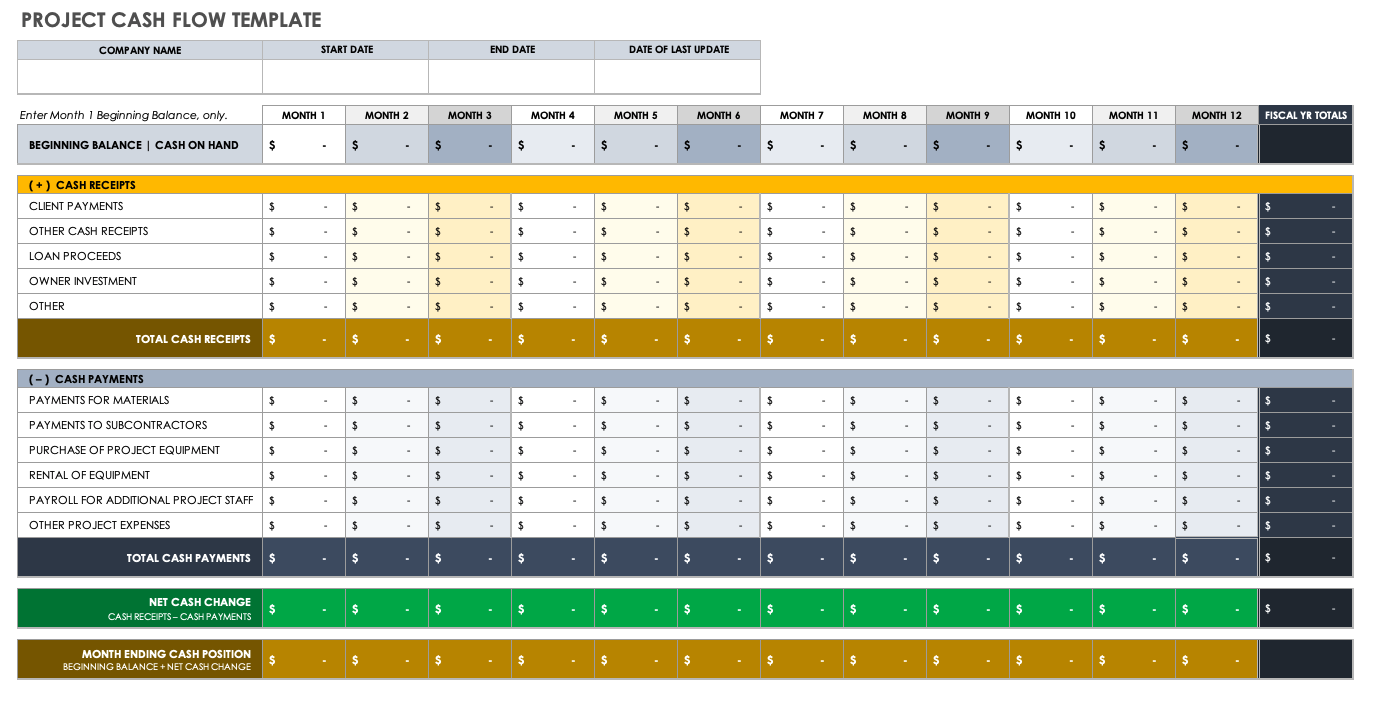

Project Based Cash Flow Analysis Guide Smartsheet

Total Assets Formula Formula Calculation Explanation

How To Calculate Initial Investment Operating Cash Flow Terminal Cash Flow For Capital Budgeting Youtube

Disposal Of Assets Disposal Of Assets Accountingcoach

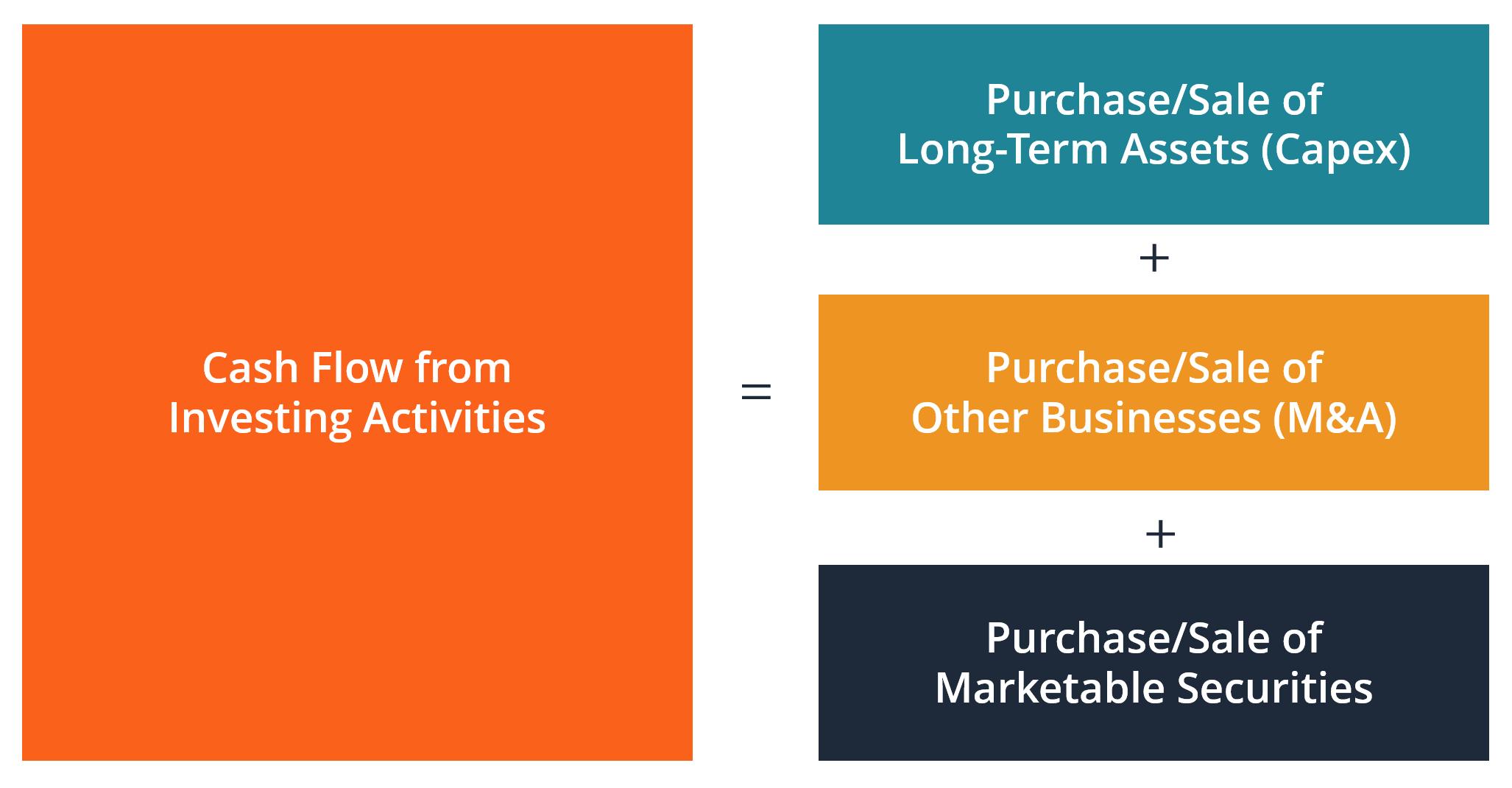

Cash Flow From Investing Activities Financial Edge

How To Calculate The Cash Flow From Investing Activities

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Statement Operating Financing Investing Activities Accountingcoach

Price To Cash Flow Ratio Formula Example Analysis Guide Definition

Cash Flow From Investing Activities Overview Example What S Included

Types Of Cash Flow Operating Investing And Financing Explained Upwork

Cash Flow Statement Explanation And Example Bench Accounting

Profit And Cash Flow What Is The Difference Business Tutor2u

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities